Why dropdead is the best:

Why buy term life insurance from dropdead:

How to buy term life insurance from dropdead:

Why buy term life insurance from dropdead:

How to buy term life insurance from dropdead:

1

Add an Extra $200k to your will For pennies a day

2

Pushing Up Dollars not daisies

3

“It’s OK. A Wad Of banknotes will help dry those tears.”

The Breakdown

Life Insurance

What is Life Insurance?

By purchasing insurance, you provide financial security to your family should you die prematurely. In the event of your death, your life insurance will be paid out to your family, easing the financial burden that may be put on them without insurance. This is especially beneficial for families with young children, or a family in which the insured individual is the main provider.

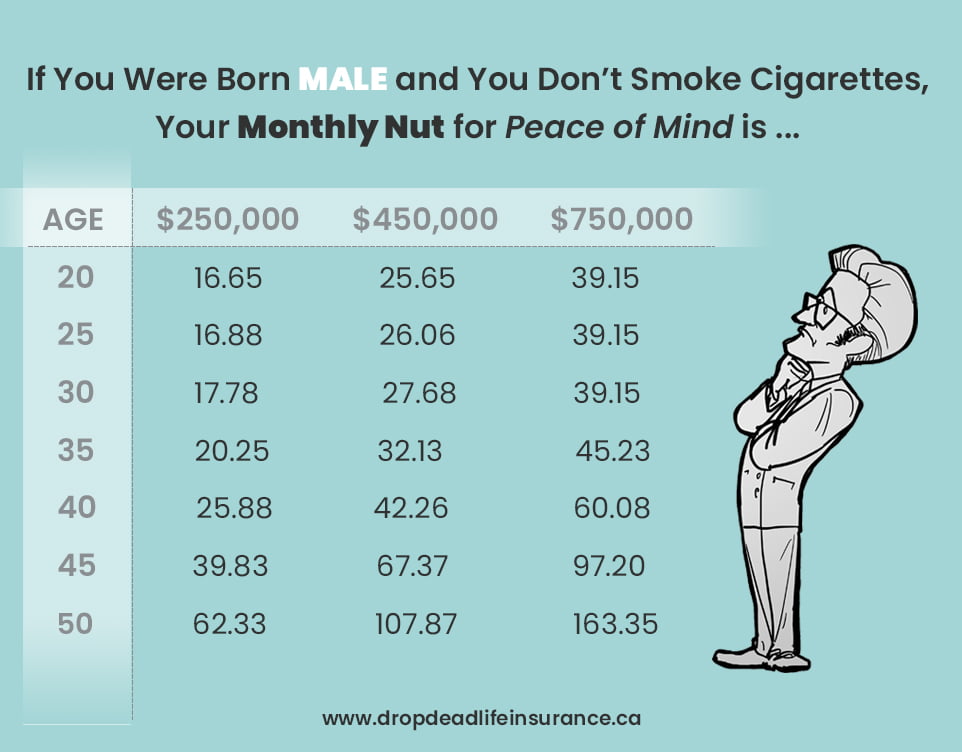

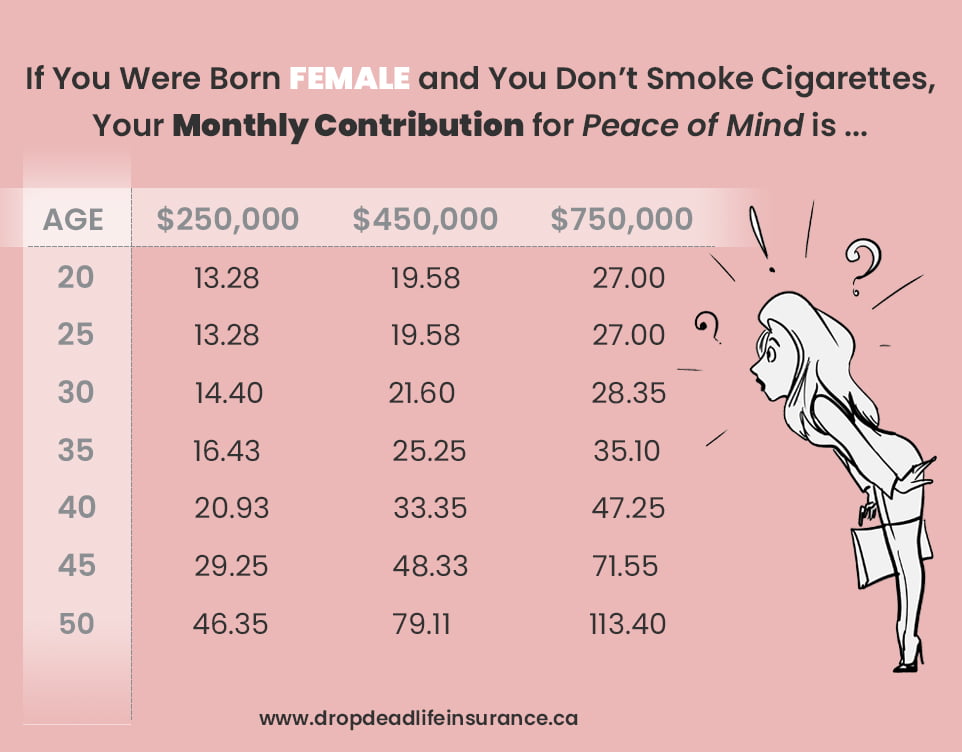

Just because life insurance is important, doesn’t mean it has to be complicated. We get it, life happens and loved ones depend on you. Ensure there is money left behind for your family to live comfortably. Experts recommend buying life insurance coverage that is 7 – 10 times your annual salary, or use our calculator to figure out a number that suits your needs.

Term Life Insurance

What is Term Life Insurance?

For those who don’t feel comfortable having a permanent insurance program, term life insurance allows you a more affordable option that offers flexible protection. These plans offer a specified period of time where your premiums and coverage are locked in but will be renewed at a revised premium after each term.

Term life insurance provides your family with a financial payout in the event that you pass away within the period of your 20-year term.